How much will gold be worth in the future - gold prices in 10 years

Contents:

Gold prices hit new records. Gold as a metal, in addition to its aesthetic properties, is also a good investment. How much will we earn on gold bought in 2021? What are the gold price forecasts for the next 10 years? The answer is in this article.

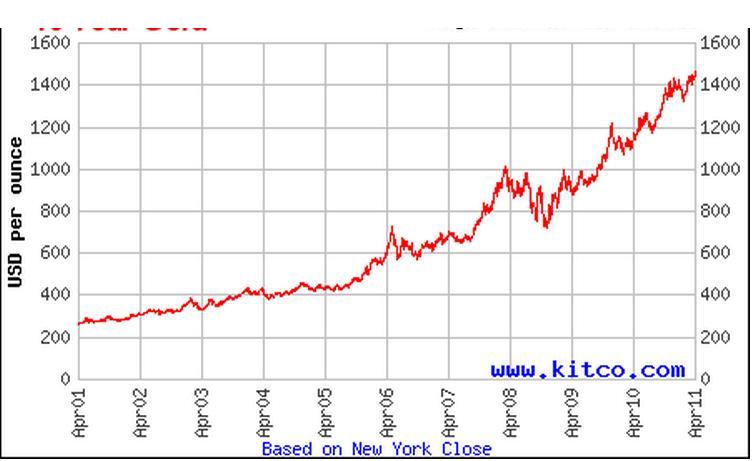

2020 has been a very favorable year for people who have invested in gold. The price of gold bars has risen significantly, which has been going on for several years. Whether gold will still be a profitable investment, no one can guarantee, but fortunately there are forecasts, speculations and probability calculations. It is important to follow trends and observe the market.

2020 and rising zloty prices

Gold prices have risen significantly in 2020 however, this is nothing compared to future forecasts. In US dollars, the increase in the price of gold is estimated at 24,6%and in euro this increase is slightly less, but still significant and amounted to 14,3%. The rise in prices, of course, is connected with the situation in the world. It cannot be denied that the pandemic has had an impact on the global economy. Bullion prices rose as a result of predicted inflation and attempts to hedge against it.

In 2020 of the year the price of gold reached a record high in many currencies, in turn, at the beginning of 2021, the price of the metal corrected slightly. The average price per ounce was $1685. In June, after the revision, it amounted to 1775 US dollars. This is still a very high price.

The future increase in gold prices - what will it bring?

For the Polish economy, the rise in gold prices is of great importance. It's a win-win situation. It should be noted that in recent years the National Bank of Poland has purchased 125,7 tons of gold. Investments amounted to 5,4 billion US dollars. In 2021, the value of the metal has already reached $7,2 billion. Are Gold Price Predictions Correct for the Next Decade? The NBP could receive almost $40 billion.

According to forecasts, investing in gold is still profitable, maybe even very profitable. When buying gold, you can safely invest your capital and be calm about inflation and other troubles in the world markets.

Will gold continue to rise? Crazy predictions for the coming years

According to the annual report prepared over the years by Incrementum from Liechtenstein It is estimated that in 2030 the price of gold could rise to $4800 per ounce. This is an optimized scenario that does not assume galloping inflation. With a sharp increase in inflation, gold prices can rise even more. The most optimistic forecast is $8000 per ounce. This means that gold price growth will exceed 200% within a decade.

The global situation is responsible for the rise in gold prices and forecasts for the coming years. The Covid-19 pandemic has shaken the entire world, including the global economy. The declared high inflation in many countries prompted investors to look for some kind of investment, many chose gold. Precious metal prices react to similar market forces and other commodities. Consequently an increase in demand has affected prices. According to the information contained in this year's report, it is inflation that stimulates and will continue to stimulate demand for gold.

Gold prices could skyrocket in the next 10 years

However, inflation is not the only factor that could affect the record high. rising gold prices in the next 10 years. Gold bars are also sensitive to other market factors such as central bank decisions, conflicts and the state of the world economy in the next decade. Forecast assumes things that are predictablehowever, this remains only a prediction for now. There are many things that no one can predict that are happening that have a huge impact on markets around the world, including the price of gold.

In 2019, no one even thought that the scenario that 2020 showed the world, the pandemic and all its consequences, was possible. Gold has always been considered a safe investment. Unstable times contribute to increasing interest in traditional, but reliable investments. History has shown us many times that regardless of forecasts - investing in gold always pays off.

Leave a Reply