How to properly insure your art collection

Contents:

- Art insurance is your protection against the unexpected

- Be aware that not all insurances cover fine art.

- 1. Does my art collection cover homeowners insurance?

- 2. What are the benefits of working with a standalone fine art insurance company?

- 3. What is the first step in insuring my art collection?

- 4. How often do I need to schedule an assessment?

- 5. How can I keep the origin and valuation documents for my insurance coverage in a timely manner?

- 6. What are the most common claims?

- Don't wait to reduce your risk

Art insurance is your protection against the unexpected

Like homeowners insurance or health insurance, although no one wants an earthquake or a broken leg, you need to be prepared.

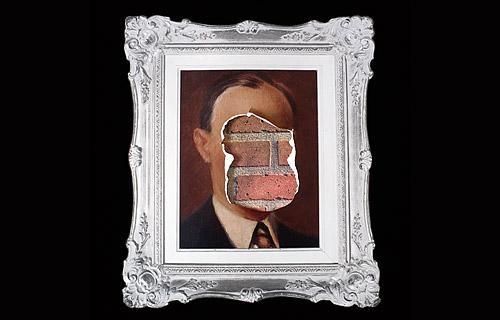

We consulted two art insurance specialists and both had scary stories. Things like pencils sliding over paintings and red wine glasses flying at canvases. Interestingly, in each case, the art collector went to the insurance company after the incident, looking for a restoration expert and art insurance coverage.

The problem with insuring a painting after a pencil has made a hole in it is that you won't get a cent of a refund for the restoration or loss of value of your work.

Be aware that not all insurances cover fine art.

After speaking with Victoria Edwards of Fine Art and Jewelry Insurance and William Fleischer of , we learned that art collectors need to be ready for anything.

Consider these questions as your starter kit for proper insurance for your art collection:

1. Does my art collection cover homeowners insurance?

One of the first questions people ask is, “Does my homeowner’s insurance cover my work?” Homeowners insurance covers your valuables subject to your deductible and coverage limits.

“Some people think their homeowners insurance covers [fine art],” explains Edwards, “but if you don’t have a separate policy and you think your homeowners insurance covers it, you need to check for exclusions.” It is possible to buy a special coating for certain items, such as works of art, which will cover their latest appraised value. This is something you need to do your due diligence as an art collector.

“A homeowner's insurance policy is generally not as complex as an art insurance policy,” Fleischer explains. “They have a lot more restrictions and a lot more underwriting. As the art market has become much more sophisticated, homeowner politics is not the ideal place for your coverage.”

2. What are the benefits of working with a standalone fine art insurance company?

“The advantage of working with a broker who actually specializes in art insurance is that we work on behalf of the client, not the company,” explains Edwards. “When you work with a broker who works on your behalf, you get personalized attention.”

Art Insurance specialists are also more experienced in creating policies to protect your art collection and know how to help in claims situations. When you file a claim with an art insurance specialist, your collection will be taken very seriously. With a general homeowner's insurance policy, your art collection is nothing more than part of your valuables. “The art insurance company focuses on art,” says Fleischer. "They understand how claims are handled, how appraisals work, and they understand the art movement."

As with any insurance policy, be aware of what is covered. Some personal rules exclude recovery. This means that if your piece is damaged (imagine red wine flying onto a canvas) and needs to be repaired, you will be responsible for the cost. If you need to send the painting to a restorer, the cost may decrease. Fleischer also notes that an art insurance policy reduces the market value if included in your insurance.

3. What is the first step in insuring my art collection?

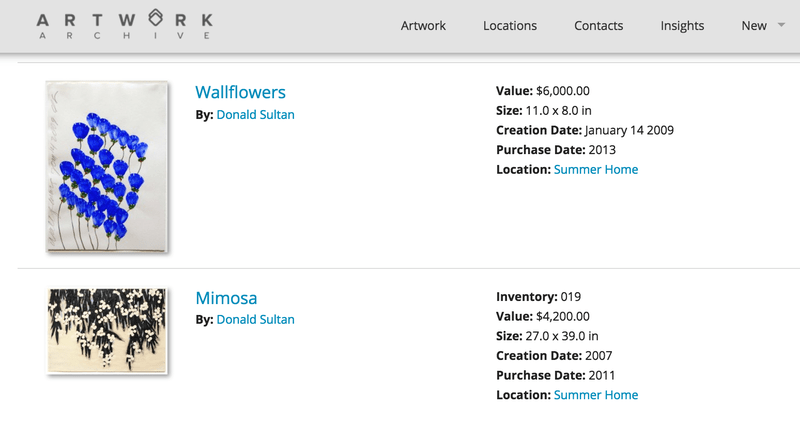

The first step to insuring your art collection is to collect provenance or all the necessary documentation to prove that the art belongs to you and how much it currently costs. These documents include the title deed, bill of sale, provenance, replacement appraisal, photographs, and most recent appraisal. You can store all of these documents on your profile to keep everything organized and easily accessible in the cloud. The frequency with which valuation documents are updated depends on each company's underwriting philosophy.

4. How often do I need to schedule an assessment?

Fleischer suggests an updated assessment once a year, while Edwards suggests every three to five years. There is no wrong answer, and the frequency of ratings depends heavily on the age and material of the work. You can ask these questions to your insurance representative. While it can sometimes be as simple as submitting invoices, you usually want updated values from the last few years. “Perhaps [this thing] originally cost $2,000,” Edwards suggests, “and in five years it will cost $4,000. We want to make sure that if you lose, you get $4,000."

If you are planning an updated estimate, please indicate that it is for insurance purposes. This will give you the most current market value of your artwork. This is important not only for insurance, but also for analyzing the total value of your collection, filing taxes, and selling art.

5. How can I keep the origin and valuation documents for my insurance coverage in a timely manner?

When you're constantly adding items to your collection and updating your appraisal papers, it's important to stay organized. An archive system like this is a great way to keep everything you need in one easily accessible place that you can access anytime, anywhere. "Your site is perfect." Edwards says. “As far as being able to let your customers output descriptions and values and say here is a list of things I want to insure, that would make it very easy.”

Having all your documents in one place allows you to properly manage the value of your art collection. Accurate information also reduces the risk under your insurance policy.

6. What are the most common claims?

The most common claims between Fleischer and Edwards are theft, robbery, and damage to artwork in transit. If you are moving or lending part of your collection to museums or other places, make sure your art insurance broker is aware of this and is involved in the process. If the loan is international, keep in mind that insurance policies vary from country to country. "You want to make sure there's door-to-door coverage," says Edwards, "so when they pick up the painting from your home, it's covered on the way, in the museum, and on the way back to your home."

Don't wait to reduce your risk

The best way to make sure your insurance policy covers everything you need is to call your local broker or start calling potential brokers and asking questions. “Ignorance is no defense,” Fleischer reveals. “Not having insurance is a risk,” he continues, “so are you taking the risk or are you hedging the risk?”

Your art collection is irreplaceable, and art insurance protects your assets and investments. It also ensures that even in the event of a catastrophic claim, you can continue to collect. “You never expect anything to happen,” Edwards warns, “having insurance gives you peace of mind.”

Appreciate what you love and take care of it. Get more expert advice on finding, buying and caring for your collection in our free eBook, available to download now.

Leave a Reply